Solana Price Recovers as 71% Traders on Binance Predict a Bullish Breakout

0

0

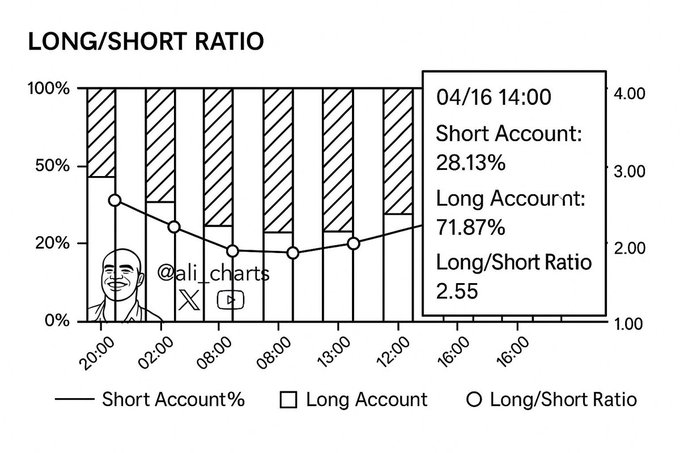

Solana price has recovered recently, with the cryptocurrency experiencing a 40% increase in value over the past 10 days. The SOL price surge comes as 71% of traders with open positions on Binance are betting on Solana’s upward movement. The rally has sparked increased optimism among investors, with many expecting further gains soon.

Traders Predict Solana Price Bullish Momentum

According to crypto analyst Ali Charts, many traders on Binance are positioning themselves for Solana’s continued upward movement. The data shows that 71.87% of traders with open Solana positions are betting on its price rise. This sentiment aligns with the recent surge in Solana’s value, which has increased by 40% from $95 on April 7 to approximately $133 on April 17.

This growing confidence is reflected in the trading volumes, which soared 33% in the last 24 hours to $4.53 B.

In addition, the rising interest from institutional investors, such as real estate fintech firm Janover, which added over $10 million worth of Solana to its holdings, has also contributed to the bullish sentiment. Moreover, with the launch of Solana-based ETFs in Canada on April 16, optimism for the SOL price rally is continuing to grow.

Institutional Involvement in Solana’s Growth

Solana has recently attracted significant institutional interest, with firms like Janover doubling their holdings. Janover, for instance, purchased 80,567 SOL tokens for $10.5 million, bringing its total treasury to 163,651 SOL. This move, as a result, signals a growing belief in Solana’s long-term potential as an investment asset.

Similar to the playbook of MicroStrategy’s Bitcoin strategy, Janover’s actions suggest that more traditional financial entities are exploring Solana for its growth potential and staking opportunities.

Moreover, the growing institutional adoption of Solana is not just limited to investments but also extends to its infrastructure. Coinbase has recently upgraded its Solana infrastructure to provide faster block processing and improved RPC performance.

Liquidity Inflows Strengthen Solana’s Market Position

Concurrently, another key factor contributing to Solana’s recovery is the increasing liquidity inflow into the network. Data from deBridge shows that over $120 million in liquidity was bridged from other blockchains to Solana over the past 30 days.

Ethereum contributed the largest portion, transferring $41.5 million to Solana. This influx of capital strengthens Solana’s position as a leading blockchain network, supporting its price movement.

The liquidity flow has coincided with a broader resurgence in Solana’s decentralized exchange (DEX) activity. In Q1 2025, Solana led all chains in DEX trading volume, capturing 39.6% of the market share with $293.7 billion in volume. These trends indicate a heightened demand for Solana’s services, fueling investor optimism.

SOL Price Analysis Backs Bullish Breakout

According to an analysis from TradingView, Solana’s price has broken out from a falling wedge pattern, which is typically seen as a bullish signal in technical analysis. This breakout occurred after Solana rebounded from a multi-year support trendline near $95 and moved above the upper trendline of the wedge at $120.

Traders now look toward a potential SOL price target of $200, representing a 50% increase from the current price level. As of press time, the SOL price was trading at $134, a 4.50% surge from the day’s low and 23% up from the weekly low.

In addition, Solana’s Relative Strength Index (RSI) has increased from 33 to 55 since early April, indicating rising bullish momentum. However, for Solana’s price recovery to remain intact, it must maintain support above the 50-day simple moving average (SMA) at $130 and overcome resistance between $160 and $180, where the 100-day and 200-day SMAs lie.

The post Solana Price Recovers as 71% Traders on Binance Predict a Bullish Breakout appeared first on CoinGape.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.