Altcoins Season Alert? Stalling Bitcoin Dominance Sparks Optimism

0

0

As of April 15, 2025, Bitcoin’s dominance in the crypto market has stalled at 63.3%, triggering one of the most heated debates across the digital asset ecosystem: Is an altcoins season finally coming? The answer, while not definitive, is beginning to take shape — and it’s painting a vivid picture of shifting investor sentiment and liquidity flow.

The Significance of BTC Dominance Stalling

Bitcoin dominance measures BTC’s share of the total crypto market cap. When dominance rises, capital flows into Bitcoin; when it stalls or drops, altcoins tend to shine. Currently, the metric has plateaued at 63.3%, a notable level that hints at potential capital redistribution. Historically, such pauses have acted as precursors to an altcoin breakout.

“The stalling of BTC dominance at these levels could be the market’s way of catching its breath before altcoins take the lead,” commented Lena Andersen, an analyst at AMB Crypto.

Price Stability Reinforces Investor Caution

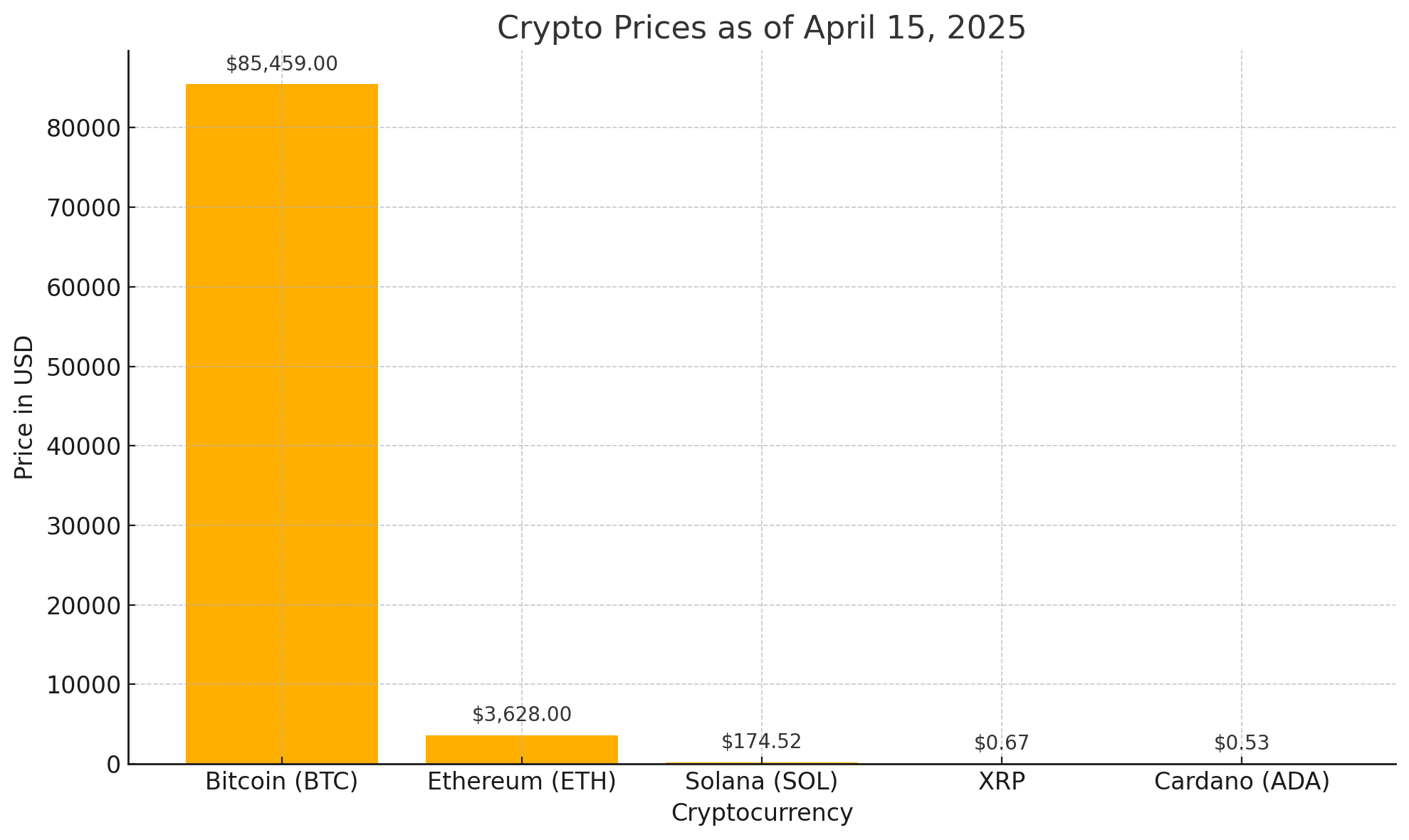

At press time, Bitcoin is trading at $85,459, holding steady above a crucial support zone near $65,000. This consolidation is being closely watched by institutional and retail traders alike.

| Cryptocurrency | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

| Bitcoin (BTC) | $85,459 | +1.29% | $1.69T |

| Ethereum (ETH) | $3,628 | +1.84% | $435B |

| Solana (SOL) | $174.52 | +2.43% | $78B |

| XRP | $0.672 | +1.07% | $36B |

| Cardano (ADA) | $0.532 | +1.55% | $18.9B |

With Bitcoin’s price stable and dominance no longer climbing, many analysts interpret this as a cooling-off period that could lead to altcoin outperformance in the coming weeks.

What Is the Altcoins Season Index Saying?

While excitement brews, data from the Altcoin Season Index suggests caution. For a true altseason to be declared, at least 75% of the top 50 altcoins must outperform Bitcoin over a 90-day period. Currently, that threshold hasn’t been met — but momentum is slowly building.

Ethereum is leading the charge, showing renewed strength after bouncing off the $3,400 level. Solana, with its expanding DeFi ecosystem and NFT traction, is also gaining ground. XRP and Cardano are not far behind, buoyed by community support and development updates.

Traders Begin Repositioning Portfolios

As Bitcoin consolidates, short-term holders and miners are showing signs of distribution, while long-term holders remain unfazed. This behavior typically signals an inflection point, where capital begins flowing into riskier, higher-upside assets.

“Altcoins are like sleeping giants right now,” said Marco Delano of CryptoQuant. “With BTC dominance flattening, we could see serious upside for well-positioned altseason over the next month.”

Macro Conditions Favor Diversification

With regulatory uncertainty easing in the U.S. and global liquidity improving, conditions appear ripe for broader crypto participation. The SEC’s softer stance under Chairman Paul Atkins and fresh institutional inflows into spot ETFs are increasing overall market confidence — especially in non-Bitcoin assets.

Moreover, sentiment on platforms like X (formerly Twitter) and Reddit’s r/CryptoCurrency is increasingly focused on altcoins. Popular influencers are rotating content towards Ethereum Layer-2s, Solana’s growing DePIN sector, and undervalued DeFi tokens.

Conclusion: Is Altseason Here?

While the Altcoin Season Index doesn’t flash green just yet, market conditions are lining up for a possible altcoin surge. Bitcoin dominance stalling at 63.3% is not a guarantee, but it’s an early warning sign of change.

“Altseason is not a matter of if — but when,” said crypto strategist Rachel Yun. “We’re seeing the same buildup we saw in early 2021. Smart money is already diversifying.”

Investors should keep a close eye on dominance trends, support levels, and ecosystem growth across major altcoins. The next leg of the market may not be led by Bitcoin — and that’s where opportunity lies.

Frequently Asked Questions (FAQs)

What does Bitcoin dominance mean?

Bitcoin dominance refers to BTC’s share of the total cryptocurrency market capitalization. A drop often indicates rising interest in altseason.

What’s the current Bitcoin price?

As of April 15, 2025, Bitcoin is trading at approximately $85,459, with minor intraday fluctuations.

Has the altseason officially started?

Not yet. For an official altseason, 75% of the top 50 altcoins must outperform Bitcoin over a 90-day period — a condition that hasn’t been met.

Which altcoins are showing strength right now?

Ethereum, Solana, XRP, and Cardano are among the top altseason gaining momentum as BTC dominance stalls.

Glossary of Key Terms

Altseason: A market phase where altcoins outperform Bitcoin in terms of percentage gains.

Bitcoin Dominance: The ratio of Bitcoin’s market cap to the total crypto market cap.

Altcoin Season Index: A metric that tracks whether altcoins are outperforming BTC over a 90-day period.

DePIN: Decentralized Physical Infrastructure Networks – a growing sector on Solana and other chains.

Support Level: A price level where an asset tends to find buying interest, preventing further decline.

Sources

Read More: Altcoins Season Alert? Stalling Bitcoin Dominance Sparks Optimism">Altcoins Season Alert? Stalling Bitcoin Dominance Sparks Optimism

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.