Bitcoin ETFs Post Weekly Gains as Ethereum ETFs Tumble for the Eighth Time

0

0

Highlights:

- Between April 14 and 17, Bitcoin ETFs attracted net cash inflows worth $15.85 million.

- Last week, Ethereum ETFs saw only net outflows, extending its weekly losses to the eighth consecutive day.

- Bitcoin and Ethereum record slight price increments as the crypto market attempts to recover from previous declines.

After recording two consecutive losses, Bitcoin (BTC) Exchange Traded Funds (ETFs) bounced back following their impressive outings last week. Between April 14 and 17, the funds recorded profits on three occasions and net outflows on only one day to mark their first weekly net profits in April. In contrast, Ethereum saw another weekly loss, extending the negative trend to the eighth consecutive week.

Last week (April 14 to April 17, Eastern Time), the Ethereum spot ETF had a net outflow of $32.17 million, marking eight consecutive weeks of net outflows. The Bitcoin spot ETF had a net inflow of $15.85 million in a single week. https://t.co/Tvs2oCSxTg

— Wu Blockchain (@WuBlockchain) April 21, 2025

Bitcoin ETFs Previous Week Statistical Details

According to SosoValue’s data, Bitcoin ETFs gained $1.47 million and $76.42 million on the first two days of last week before succumbing to a $169.87 million net outflows on April 16. The funds bounced back with a net inflow of $107.83 million on April 17, culminating in $15.85 million weekly gains.

Before its most recent weekly gains, Bitcoin ETFs lost $172.69 million and $713.30 million in the weeks preceding the interval between April 14 and 17. Bitcoin funds recorded only weekly losses in February, which extended into the first two weeks in March. The funds, however, saw weekly gains in the last two weeks of March.

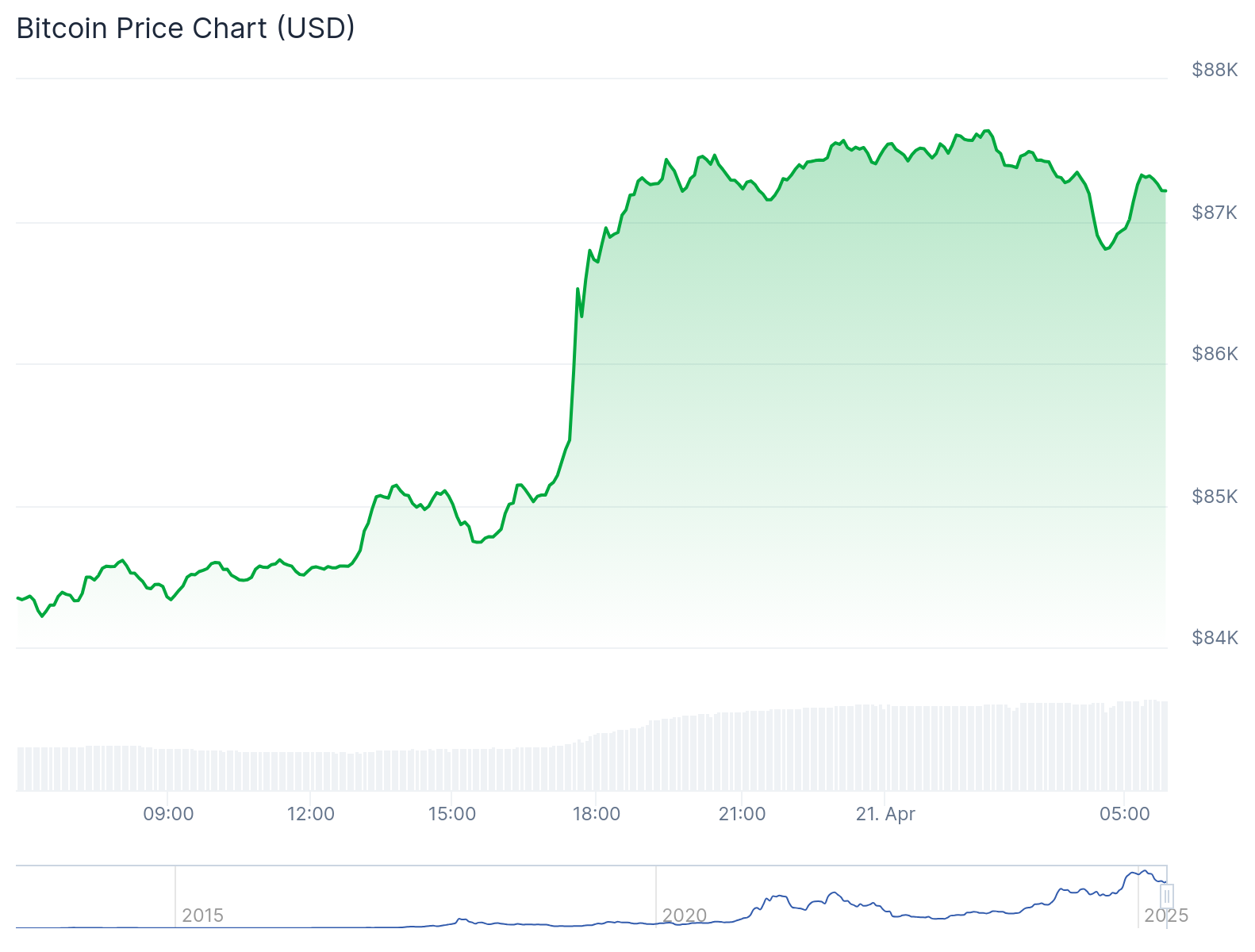

Currently, Bitcoin ETFs’ cumulative net inflow stands at approximately $35.37 billion. The total value traded reflected $1.55 billion, while the total net assets, representing 5.59% of Bitcoin’s market capitalization, was $94.51 billion. Meanwhile, Bitcoin is up 3.5% in the past 24 hours, trading at approximately $87,100. It has a market cap of about $1.73 trillion and a 24-hour trading volume of $25.2 billion.

Institutions Maintain Faith in BTC Amid Positive Bitcoin ETFs Outing

Despite its high volatility concerns, Bitcoin has continued to attract strong interest from institutions and individuals. Earlier today, Metaplanet’s Chief Executive Officer (CEO) Simon Gerovich announced that the company bought 330 BTC for $28.2 million. Today’s purchase increased Metaplanet’s Bitcoin holdings to 4,855, worth $414.5 million.

Metaplanet has acquired 330 BTC for ~$28.2 million at ~$85,605 per bitcoin and has achieved BTC Yield of 119.3% YTD 2025. As of 4/21/2025, we hold 4855 $BTC acquired for ~$414.5 million at ~$85,386 per bitcoin. pic.twitter.com/EUFSbUCOPW

— Simon Gerovich (@gerovich) April 21, 2025

Last week, Strategy, the largest corporate holder of Bitcoin, announced that it bought 3,459 BTC for $285.8 million, increasing its BTC stores to 531,644 tokens worth over $45 billion. Semler Scientific filed a registration statement with the US Securities and Exchange Commission (SEC) to raise $500 million on April 15. The company said it will use the capital to fund operations and buy more BTC

Ethereum ETFs Poor Run Persists

Unlike Bitcoin, Ethereum ETFs recorded weekly losses of about $32.17 million in the just concluded week. Between April 14 and 17, Ethereum ETFs recorded losses on the first three days. On April 17, the funds saw neither gains nor outflows.

Ethereum ETFs recorded monthly net outflows worth $403.37 million in March and could replicate a similar trend this month. Since April began, Ethereum ETFs saw net gains on April 4, marking their only profitable outing this month. Market participants have raised concerns about ETH ETFs’ unimpressive statistics and have attributed them to Ethereum’s recent struggles.

Ethereum has faced significant downward pressure in recent weeks. Despite nearing $4,000 in December and stabilizing above $3,000 in January, ETH’s price has gone downhill. It dropped below $3,000 in February before eventually depleting below $2,000 in March. Earlier this month, ETH traded around $1,400. However, it has recovered slightly, trading at about $1,620, following a 3.12% surge in the past 24 hours.

Whales are Capitalizing on ETH’s Price Struggles

Lookonchain, a renowned on-chain transaction monitor, has tracked several Ethereum acquisitions involving whales. In one of its most recent tweets, Lookonchain reported that a whale withdrew 1,897 ETH worth $3 million from Bitget. The on-chain tracker added that since April 3, this large investor had withdrawn 3,844 ETH, valued at about $6.51 million from Bitget.

Whales continue to accumulate $ETH!

A whale withdrew another 1,897 $ETH($3M) from #Bitget 10 hours ago.

This whale has withdrawn 3,844 $ETH($6.51M) from #Bitget since April 3.https://t.co/HZN9KLPt6M pic.twitter.com/0HCPswZx8w

— Lookonchain (@lookonchain) April 21, 2025

In another tweet, Lookonchain tracked a different whale that purchased 2,400 ETH, valued at about $3.85 million. In the past ten days, this big spender has acquired 12,010 ETH worth approximately $18.39 million at an average price of $1,531 per token.

A whale bought another 2,400 $ETH($3.85M) 6 hours ago.

This whale has bought 12,010 $ETH($18.39M) at an average price of $1,531 in the past 10 days.https://t.co/calmuM1Cvi pic.twitter.com/WfUm2Q9yCj

— Lookonchain (@lookonchain) April 19, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.