Large Inflows Hit Ethereum: Will ETH Price Drop Again?

0

0

The post Large Inflows Hit Ethereum: Will ETH Price Drop Again? appeared first on Coinpedia Fintech News

Ethereum has been making headlines again. After a sharp drop earlier this month, the world’s second-largest cryptocurrency is showing signs of recovery. On April 9 alone, ETH jumped 8.24%. In the past 24 hours, it has climbed another 1.5%. But fresh on-chain data is raising some concerns – there’s been a large and unusual flow of ETH into derivatives exchanges.

Could this be a warning sign of another dip?

A Rocky April for Ethereum

Ethereum began the month at $1,821.51. On April 2, the price briefly touched $1,957.94 but dropped back down to $1,794.51 by the end of the day.

From April 5 to 8, ETH fell more than 18.86%. Since April 9, however, the market has shown signs of recovery with a gain of 7.82%.

The second week of April has been calmer. Between April 7 and 13, Ethereum edged up by 2.83%. This was a slight improvement compared to the previous week.

Still, over the past seven days, the overall gain has been just 0.1%, showing that the market remains cautious.

Big Inflows to Derivatives: A Red Flag?

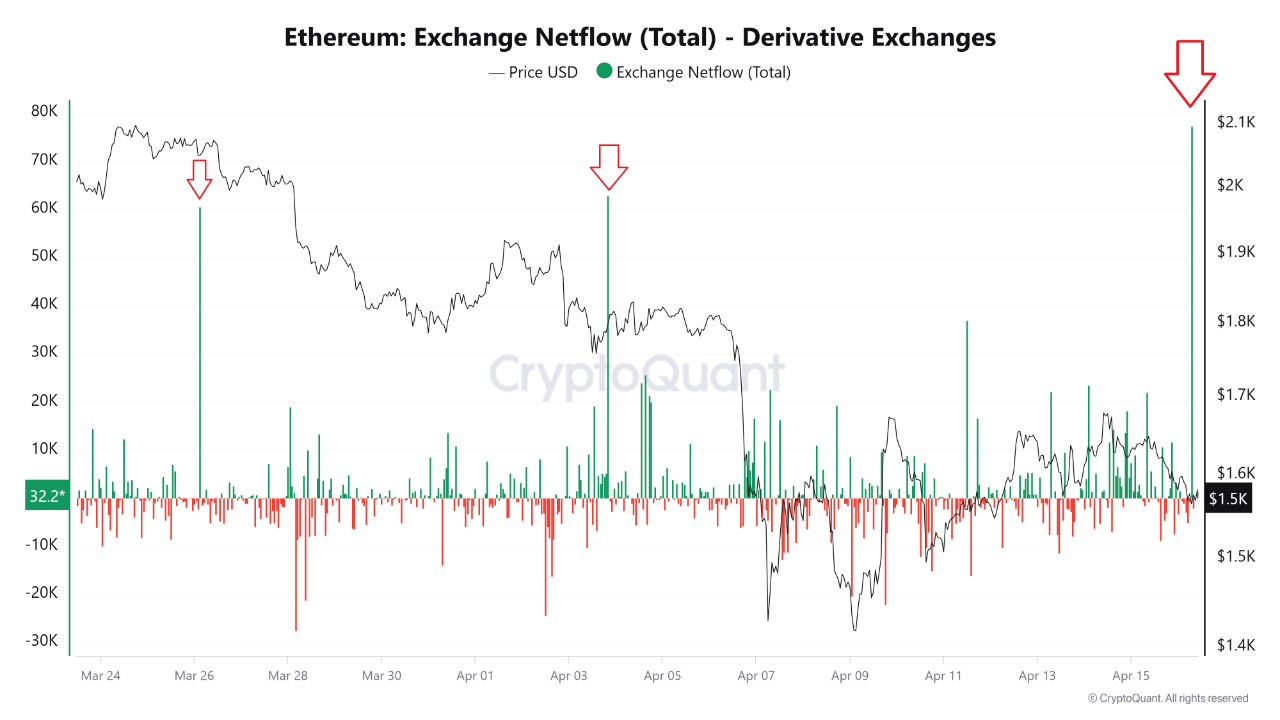

Yesterday, over 77,000 ETH were moved to derivatives exchanges, according to the Ethereum Exchange Netflow chart. This is the largest daily inflow seen in March and April.

On the same day, ETH’s price dropped from $1,588.44 to $1,577.07—a 0.71% decrease. At one point, it even hit a low of $1,537.28.

Such inflows usually suggest traders are preparing for downside moves—either by hedging their positions or opening shorts.

This isn’t the first time we’ve seen this pattern. Similar, though smaller, inflows happened on March 26 and April 3. In both cases, the market reacted with steep corrections.

From March 25 to 30, ETH dropped 13.05%. Another correction followed from April 4 to 8, with the market falling by 18.92%.

Tariff Tensions and Crypto Volatility

Ethereum’s price swings are also being shaped by bigger global issues. The U.S. government’s aggressive tariff policies under the Trump administration have caused turbulence across major asset classes, including cryptocurrencies. Even though there’s now a 90-day pause on the policy, uncertainty continues to affect investor sentiment.

Since April 1, the overall crypto market has slipped by 0.38%, while the altcoin market is down 4.42%. Ethereum alone has dropped by at least 12.56% during the same period.

- Also Read :

- Crypto Price Prediction 2025: Coinbase Predicts Crypto Rebound by Mid-2025 After Tariff Turmoil

- ,

Ethereum Market Outlook: What Traders Should Watch Next

Ethereum had a strong run in recent years, growing 90.8% in 2023 and 46.1% in 2024. But this year has started rough. In the first quarter of 2025, ETH fell by 45.3%. That’s a sharp contrast to Q1 2024 and Q1 2023, when the market rose by 59.8% and 52.4%, respectively.

While Ethereum is showing some short-term recovery, the large inflows to derivatives exchanges are a potential warning sign. Combined with ongoing global economic tensions, the short-term outlook remains uncertain.

For now, Ethereum investors should stay alert – both to market charts and global headlines.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

As per our Ethereum price prediction 2025, the ETH price could reach a maximum of $5,925.

The largest altcoin’s price could propel to a maximum of $6,925 in 2025. ETH is expected to cross the $15,575 mark by 2030.

As per our latest ETH price analysis, Ethereum could reach a maximum price of $123,678.

By 2050, a single Ethereum price could go as high as $255,282.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.