Ethereum Scalability on the Edge: As $120M Flows to Solana, Is ETH Losing Its Crown?

0

0

Ethereum, the once-uncontested king of smart contracts, is now navigating increasingly choppy waters. As fresh capital pours into Solana — over $120 million bridged from rival chains in just 30 days — crypto watchers are asking the tough question: is Ethereum Scalability losing its iron grip on DeFi?

Once known as the launchpad of every major crypto trend — from NFTs to DeFi and DAO governance — Ethereum is now facing an identity crisis. The latest shift in liquidity marks a growing appetite for newer, faster, and cheaper alternatives — and Solana is front and center.

Ethereum Scalability Outflows Signal a Changing Sentiment

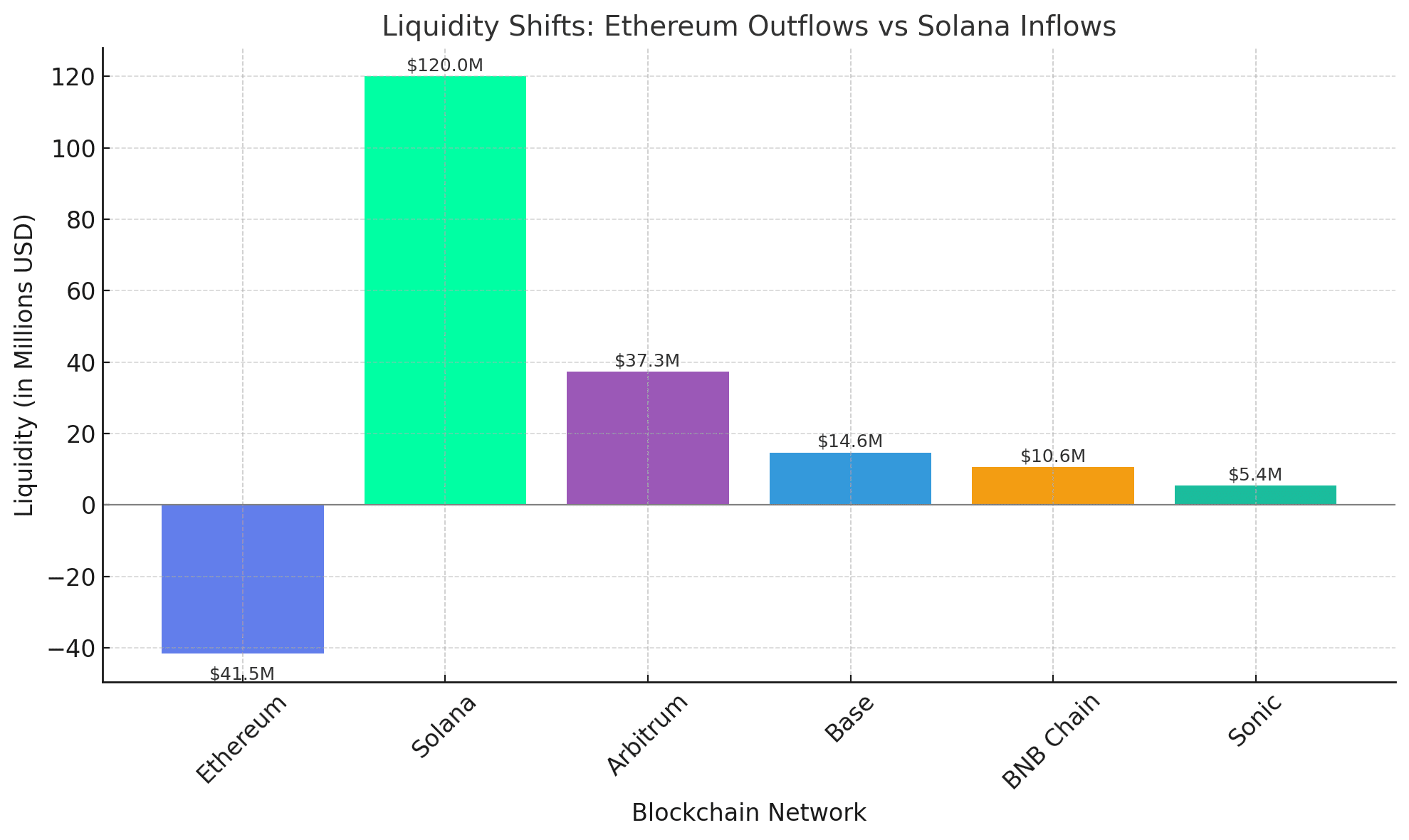

Blockchain data paints a clear picture. According to Flipside, $41.5 million was bridged from Ethereum to Solana in the past month, followed by millions more from Arbitrum, Base, BNB Chain, and Sonic. This redirection of capital highlights a broader shift in network preferences among both users and developers.

Ethereum is still home to the largest share of DeFi total value locked (TVL), but cracks are beginning to show. Scalability woes and persistently high gas fees are prompting users to explore more cost-effective blockchains. Despite the move to proof-of-stake, Ethereum Scalability hasn’t shed its image as a high-fee, congested network — and the competition is capitalizing.

“Ethereum feels like a toll booth in a decentralized future,” said crypto strategist Marwan Al-Rami. “People are tired of paying for access. Solana offers the highway — no tolls, just speed.”

Meme Coin Mania Adds Fuel to the Fire

In crypto, attention flows where the memes go — and right now, that attention has shifted sharply toward Solana. Projects like Dogwifhat (WIF) and Book of Meme (BOME) have set off a memecoin frenzy that Ethereum simply hasn’t matched in recent weeks. The result? A mass migration of retail traders and short-term speculators to Solana’s greener pastures.

Once the go-to chain for meme culture, Ethereum Scalability is now looking a little… gray. While serious protocols like Lido, Aave, and MakerDAO still thrive, the chain’s appeal to everyday traders is fading — especially when cheaper and faster alternatives are just a bridge away.

Price Check: Ethereum vs Solana

| Asset | Price | 24h Change | 7d Change | Market Cap |

|---|---|---|---|---|

| Ethereum | $3,134.88 | -0.67% | +2.72% | $376.8 Billion |

| Solana | $136.22 | -1.45% | +4.18% | $62.9 Billion |

Ethereum’s price remains relatively stable, but momentum is clearly favoring Solana. ETH is hovering near a crucial psychological support zone around $3,100, while Solana, despite technical headwinds, is aggressively inching upward in both on-chain activity and price strength.

Can Ethereum Adapt in Time?

Despite these warning signs, Ethereum Scalability still has cards to play. The upcoming EIP-4844 upgrade promises to slash rollup costs and improve scalability. Layer 2 solutions like Arbitrum, Optimism, and zkSync are already helping reduce fees, though critics argue that they add complexity to an already fragmented user experience.

“The tech is there, but Ethereum Scalability has a user experience problem,” said blockchain UX researcher Amira Javed. “Newcomers don’t want to juggle wallets, bridges, and L2s. They want fast, cheap, and simple — and right now, that’s Solana.”

Ethereum’s modular roadmap might future-proof the network in the long term, but in the short term, it risks bleeding users who are unwilling to wait for theoretical scalability.

The Verdict: Ethereum Isn’t Dying — But It’s Being Tested

Ethereum’s long-term vision remains intact. Institutional trust is high, developer talent is unmatched, and innovations continue at the protocol level. But the market is speaking — and it’s demanding speed, low fees, and fresh energy.

As one veteran investor put it: “Ethereum needs to act less like an academic paper and more like an app store.”

The verdict? Ethereum’s dominance is no longer guaranteed. It remains a powerhouse, but the age of comfortable superiority is over. Solana isn’t just nipping at its heels — it’s racing forward.

FAQs

Why is Ethereum seeing capital outflows?

Ethereum users are moving assets to faster, cheaper chains like Solana due to lower fees, especially during memecoin hype cycles.

Is Solana outperforming Ethereum Scalability?

In terms of user growth and recent inflows, yes. Solana is attracting liquidity and activity — especially among retail users.

Will Ethereum’s upgrades help?

Yes, Ethereum’s upcoming upgrades (like proto-danksharding) could improve scalability. But user patience is wearing thin.

Is Ethereum still a good investment?

Ethereum remains a top-tier blockchain with institutional backing, but its dominance is being actively challenged.

Glossary

Total Value Locked (TVL) – The overall value of assets held in DeFi protocols on a blockchain.

Gas Fees – Costs required to process transactions on Ethereum.

Layer 2 (L2) – Scaling solutions built on Ethereum to improve speed and reduce fees

Bridged Liquidity – Funds moved across blockchains via decentralized bridges.

EIP-4844 – A proposed Ethereum upgrade to reduce Layer 2 costs and improve scalability.

Sources

Read More: Ethereum Scalability on the Edge: As $120M Flows to Solana, Is ETH Losing Its Crown?">Ethereum Scalability on the Edge: As $120M Flows to Solana, Is ETH Losing Its Crown?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.