Bitcoin ETFs See $326 Million Outflows, Largest Single-Day Pullback Since March

0

0

Highlights:

- Bitcoin ETFs see $326.3 million outflows, marking four consecutive days of losses.

- Bitcoin and Ether fall as US-China trade tensions worsen, dragging the crypto market down 5%.

- Open interest in Bitcoin futures remains low, which shows reduced confidence among leveraged traders.

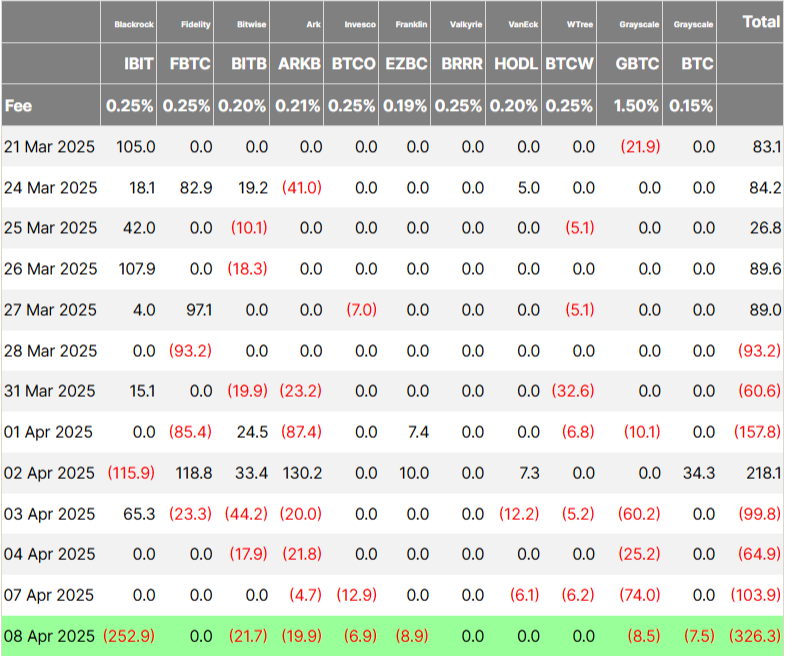

On April 9, spot Bitcoin (BTC) Exchange-Traded Funds (ETFs) recorded outflows of $326.3 million, marking four consecutive days of outflows, according to data from Farside. This was the highest single-day outflow since March 10. Large investors are pulling back their investments due to the macroeconomic pressures caused by Donald Trump’s trade wars. This shift is significant because institutional flows have played a key role in driving Bitcoin’s rally through ETF demand in the past.

BlackRock’s iShares Bitcoin Trust (IBIT) accounted for the majority of these outflows, with a net redemption of about $252.9 million. Other funds that saw withdrawals include Grayscale’s Bitcoin Trust (GBTC) with $8.5 million, Ark Invest’s ARKB with nearly $20 million, and Bitwise’s BITB with $21.7 million.

None of the leading 10 Bitcoin spot ETFs saw any inflows during the day. Funds like Fidelity’s FBTC and VanEck’s HODL saw no change, indicating a cautious market attitude.

Ethereum spot ETFs also struggled, with all nine funds collectively losing $3.3 million, and none saw fresh inflows. This decrease in ETF activity coincided with sharp sell-offs in Bitcoin and Ether during the early Asian trading session on Wednesday.

Crypto Market Drops 5% as Concerns Over Tariffs Grow

Bitcoin fell 7% to $75,523, and Ether dropped 9% to $1,417 due to concerns about the US-China trade war. Investors are worried about new tariffs from President Trump, and hopes for a quick resolution are fading. The broader crypto market lost 7% in value, now totaling $2.4 trillion. Altcoins showed small gains, but they didn’t help the overall decline.

Moreover, Open interest (OI) in BTC futures continues to remain suppressed, indicating that leveraged traders still lack confidence in the market. As of now, OI stands at $50.81 billion, showing a slight decline of 0.27% over the past day.

Bitcoin Could Recover as US Dollar Weakens

Binance CEO Richard Teng shared in an X post that Bitcoin could recover despite current investor caution. He noted that despite short-term uncertainty leading to some pullback, Bitcoin retains strong potential for recovery. Teng pointed out that many long-term holders view Bitcoin as a resilient asset during economic instability.

He stated:

“This environment could also accelerate interest in crypto as a non-sovereign store of value. Many long-term holders continue to view Bitcoin and other digital assets as resilient during periods of economic stress and shifting policy dynamics.”

There's been a lot of discussion about the recent tariff escalation, and I want to share my perspective on what this means for crypto markets both now and in the long term.

The resurgence of trade protectionism is introducing significant volatility across global markets — and…

— Richard Teng (@_RichardTeng) April 8, 2025

Matt Hougan, Chief Investment Officer at Bitwise, supported this perspective. He cited a speech by Steve Miran, Chairman of the White House’s Council of Economic Advisers. Miran’s speech highlighted how the US Dollar’s role as a global reserve currency contributes to trade deficits.

He also pointed out that the demand for the US Dollar has distorted currency markets. Hougan said that Miran is advocating for a weaker USD. This may drive Bitcoin’s price higher in the short term, as Bitcoin usually moves inversely to the US Dollar Index.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.